Maximum Annual Hsa Contribution 2025 - Maximum Hsa Contribution For 2025 Family Jolie Madelyn, $4,150 (+$300 over prior year) 2025 Hsa Contribution Limits Chart 2025 Hana Carissa, For taxpayers 50 and older, this limit.

Maximum Hsa Contribution For 2025 Family Jolie Madelyn, $4,150 (+$300 over prior year)

Irs Maximum Hsa Contribution 2025 Lee Anabella, The irs has announced the increased roth ira contribution limits for the 2025 tax year.

Global Ceo Summit 2025. +33 1 46 39 75 00. Angela beatty, senior managing director […]

2025 Hsa Contribution Limits Chart Pdf Aline Beitris, Increases to $4,150 in 2025, up $300 from 2023.

Walmart Promo Code July 2025 Free Shipping. Save with 32 walmart coupons this august 2025. […]

Maximum Hsa Contribution 2025 With Catch Up Rani Valeda, The maximum contribution for family coverage is $8,300.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Your contribution limit increases by $1,000 if you’re 55 or older.

Significant HSA Contribution Limit Increase for 2025, For taxpayers 50 and older, this limit.

+1500px.jpg?format=2500w)

Hsa 2025 Contribution Limit Irs Over 50 Alysa Bertina, Employer contributions count toward the annual hsa.

Maximum Annual Hsa Contribution 2025. If you have family coverage, you can contribute up to $8,300, compared to $7,750 in 2023. Hsa funds can cover qualified medical expenses for your spouse and dependents.

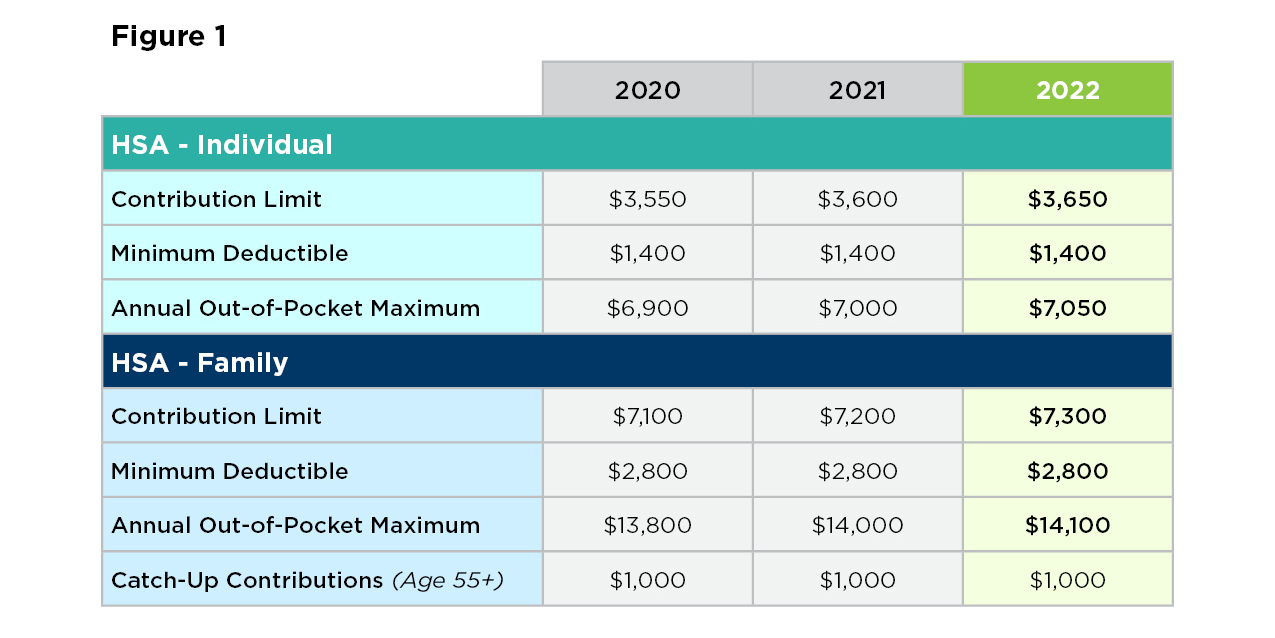

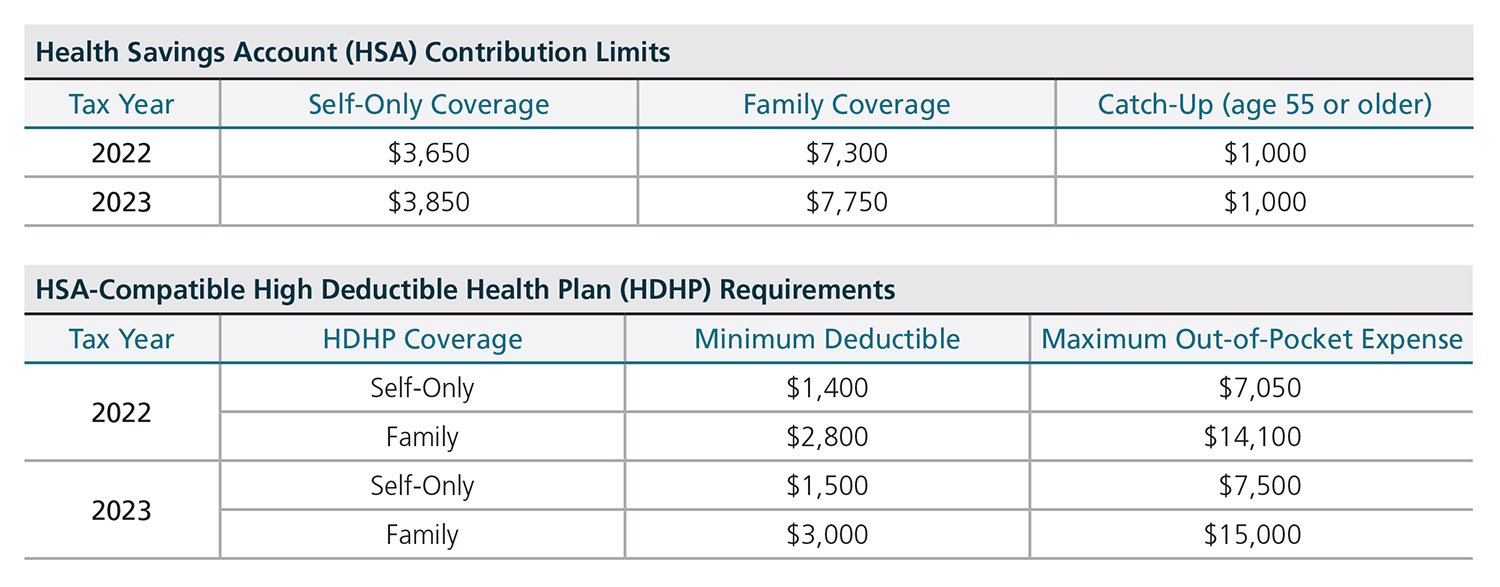

Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families. The annual hsa contribution limits under section 223(b)(2) for 2025 will be: